The iPhone 16e is gaining traction, but its real success may be more about Apple's strategy than customer demand.

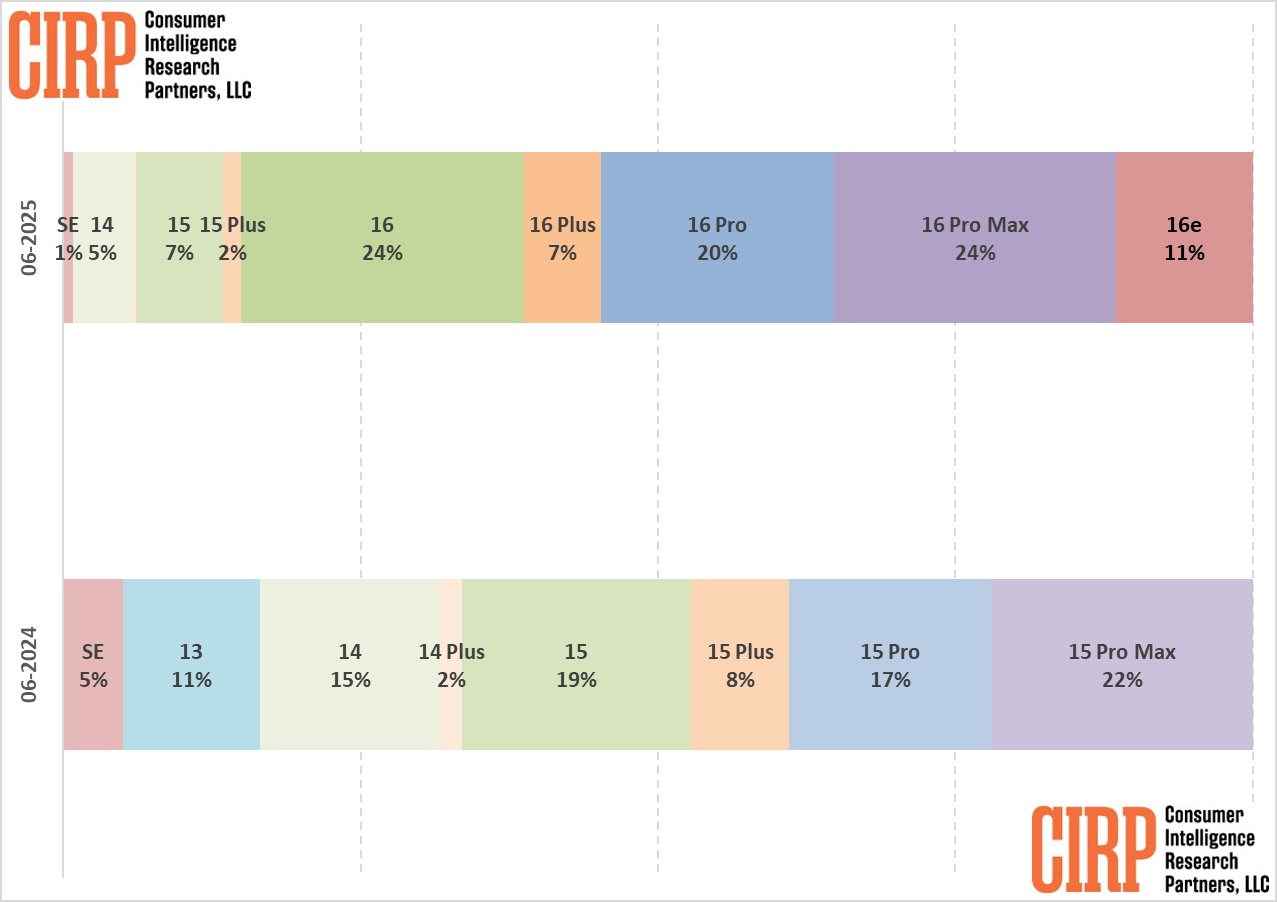

Apple's iPhone 16e accounted for 11% of US iPhone sales last quarter, more than doubling the iPhone SE's share from the same period in 2024. The data comes from Consumer Intelligence Research Partners' June 2025 survey.

The survey marks the first full quarter since Apple replaced the iPhone SE with the iPhone 16e in February. The new model pulled demand away from older iPhone 15 and iPhone 14 models, shrinking the share of legacy iPhones from 28% in 2024 to 15%.

The iPhone 16e's early success could suggest Apple has finally landed on a more sustainable low-cost approach. But its share is still modest.

Nearly 9 in 10 buyers chose a different model, and there's a case to be made that many simply didn't have another budget-friendly option.

Unlike the older iPhone SE, which started lower, the iPhone 16e is more expensive with fewer premium features than the standard iPhone 16. Apple has often used older models for the low-end market.

Now, with legacy devices declining in sales, users are being encouraged to upgrade to newer, more expensive models.

iPhone 16 family remains dominant

Many buyers still prefer the latest full-featured models, even with the iPhone 16e offering a lower-cost entry point. The mainline iPhone 16 options include the standard, Plus, Pro, and Pro Max.

These continue to anchor Apple's lineup and appeal to users who want better cameras, larger displays, or premium materials. For most customers, the tradeoff between price and features still leans toward spending more.

The broader iPhone 16 lineup captured 74% of total US iPhone sales. That's up from 66% for the iPhone 15 family in the same quarter in 2024.

Every model in the iPhone 16 series gained market share over its predecessor, except for the iPhone 16 Plus. Analysts at CIRP speculate Apple might discontinue the Plus model later in 2025 and replace it with the iPhone 17 Air.

Apple's move to retire older phones may help streamline software support and reduce fragmentation, but the benefits aren't evenly shared. Most of the upside goes to Apple.

With more people on newer devices, it becomes easier for the company to roll out features like Apple Intelligence. These features depend on recent chips and higher performance.

Premium sales still lead the way

Despite the iPhone 16e's momentum, Apple's top-tier models remain the most popular. The iPhone Pro and iPhone Pro Max continue to grow in market share, and there's little sign that an improved entry-level phone is eating into premium demand.

The iPhone 16e is still a stripped-down device, even with the latest processor. It lacks the display, camera, and build quality of more expensive models.

That makes it a good fit for users who want up-to-date software support without the bells and whistles. However, it's not likely to change Apple's overall revenue mix.

Looking ahead, a successor in the form of an iPhone 17e may arrive in early 2026. If that happens, Apple could push more users toward the latest hardware cycle.

But there's a tradeoff. With fewer truly affordable options, Apple's low end is starting to look a lot like its midrange.