Apple has clinched the top spot in global smartphone shipments for the first quarter of 2025, riding strong demand for the iPhone 16e and expanded presence in emerging markets.

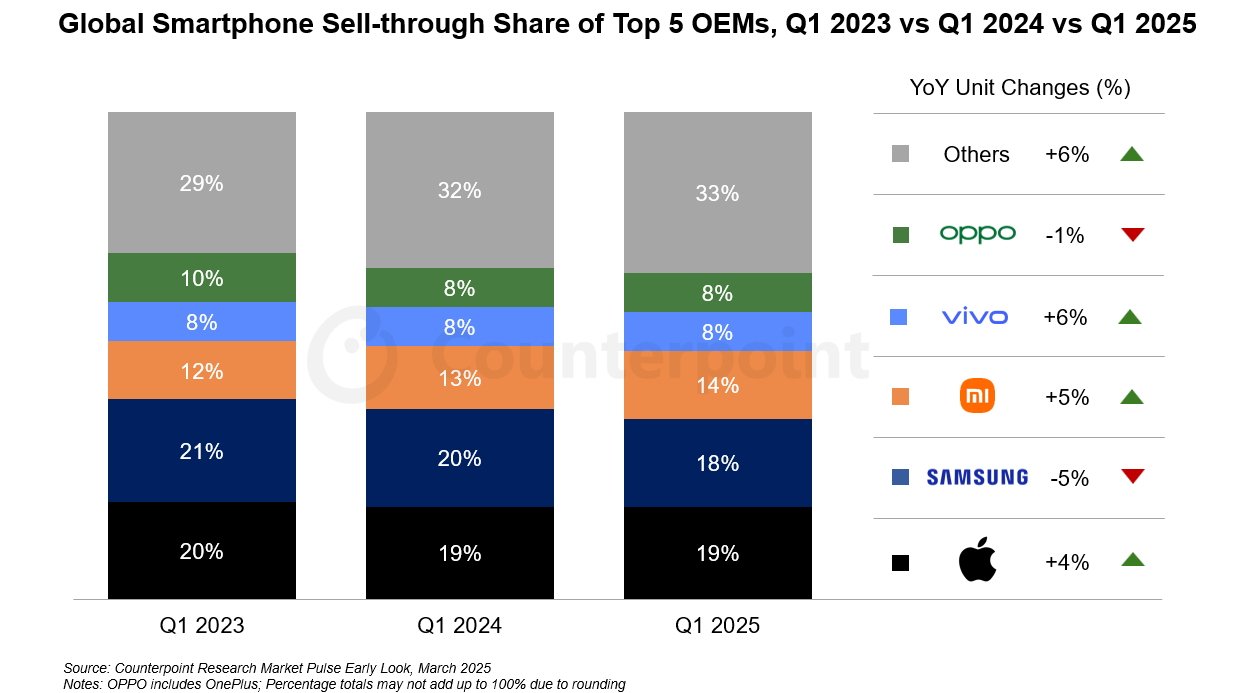

According to a new report from Counterpoint Research, Apple captured 19% of the global smartphone market in Q1 2025, edging past Samsung's 18% share despite flat or declining sales in the U.S., Europe, and China.

The company saw double-digit growth in Japan, India, Southeast Asia, and the Middle East & Africa — regions it's historically treated as secondary, but which have grown increasingly important to its bottom line.

The broader smartphone market grew 3% year-over-year in Q1, helped by a demand surge in China thanks to government subsidies and a recovering economy in Latin America, Asia-Pacific, and other emerging markets. January was particularly strong, with momentum carrying through product launches like Samsung's Galaxy S25 and Apple's mid-cycle iPhone 16e.

Why Apple's Q1 win matters

Apple's Q1 lead is unusual. The company typically peaks in Q4 after its annual fall iPhone launch, while Q1 is dominated by Android OEMs. By launching the iPhone 16e earlier in the year, Apple is reshaping its sales cycle and going head-to-head with Samsung in a traditionally Android-heavy season.

Its win also reflects a deeper shift in where its growth is coming from. With smartphone saturation in North America and Europe, Apple is seeing momentum in emerging regions where adoption is still climbing.

India and Southeast Asia are particularly strong, offering volume growth that's been harder to achieve in its core markets. Apple has leaned into this trend by boosting distribution, launching more accessible models, and focusing on region-specific services.

Economic uncertainty clouds the outlook

Still, the rebound may be short-lived. Counterpoint analysts warn that rising economic uncertainty, growing trade tensions, and Trump tariffs are already beginning to weigh on consumer demand.

As a result, the firm revised its full-year forecast downward and now expects 2025 smartphone shipments to decline slightly compared to 2024. If inflation persists or trade barriers rise, even high-performing brands like Apple may face headwinds.

Samsung, meanwhile, saw a slow start to the year due to the late arrival of the S25, but recovered in March with strong sales of the flagship and A-series devices. The company also saw a rise in demand for its high-end S25 Ultra model.

Xiaomi, Vivo, and OPPO rounded out the top five, with Vivo moving up a rank thanks to strong sales in China and continued growth in emerging markets. Huawei remained dominant in China, while Honor and Motorola posted gains globally.

Despite short-term optimism, the long-term picture remains complex. Apple's Q1 lead is a milestone, but the global smartphone market is increasingly fragmented and economically vulnerable. To stay ahead, the company will need to keep evolving — not just with devices, but with market timing, pricing strategy, and regional focus.